CBO Report Highlights Rising Costs of Flood Damage on Federally Backed Mortgages Amid Climate Change

As climate change advances, the propensity for floods in the U.S. is on the rise, presenting a burgeoning threat to homeowners and the entities that back their mortgages. Increased flood risks not only escalate the likelihood of homes suffering damage but also amplify the chances of mortgage defaults, particularly in scenarios where insurance coverage falls short. This complication has been underscored in a recent analysis by the Congressional Budget Office (CBO), which details the financial implications of flood-induced damages on federally backed home loans.

The CBO’s comprehensive study, titled “The Effects of Flood Damage on the Subsidy Cost of Federally Backed Mortgages,” taps into extensive data to forecast the fiscal footprint of flood damages on mortgages supported by government initiatives. This examination unveils how such damages could swell the subsidy costs of mortgages, scrutinizing the economic ramifications for direct federal guarantees and those underwritten by Fannie Mae and Freddie Mac. With flooding incidents set to climb, this research casts a spotlight on the pressing fiscal challenges facing the housing sector.

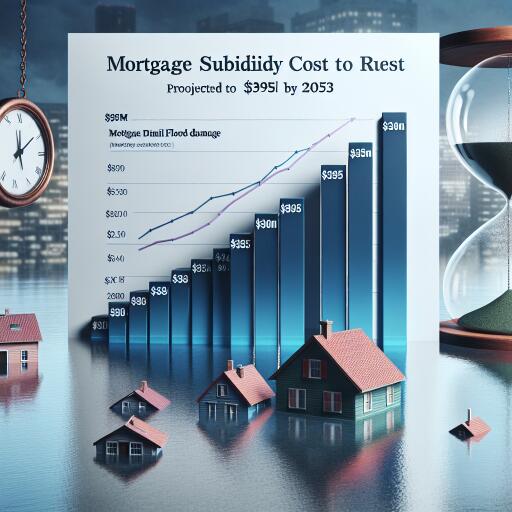

Highlighting the inherent links between climate change and flooding, recent policy adjustments by the U.S. Federal Emergency Management Agency (FEMA) now mandate consideration of future flood risks in federally funded construction projects. Reflecting this heightened awareness, the CBO projects a notable jump in subsidy costs from flood damage, estimating an increase from $275 million in fiscal year 2024 to $395 million by 2053, based on prevailing climate change projections.

The financial pressures stemming from climate change extend beyond the immediate impacts of flooding, touching upon the insurance industry and homeowners alike. An investigation into insurance costs reveals a disjointed landscape where homeowners face starkly different premiums for comparable risks, depending on their geographic locale. This disparity is not only a cause for economic concern but also underscores the broader societal and justice implications of climate risk management and insurance affordability in the face of escalating climate change dangers.

This narrative is further compounded by a continued stretch of record-setting global temperatures, asserting an unnerving trend that has persisted for over a year. With global temperatures breaching historical records, the urgency for concerted climate action has never been clearer. The trajectory towards the pivotal 1.5-degree Celsius warming threshold set by the Paris Agreement is a stark reminder of the pressing need to address climate change with unwavering resolve.

Complicating matters further is the observable impact of climate-related disasters across the United States, with states like Texas facing significant scrutiny for their handling of climate policies. Recent events, such as Hurricane Beryl, have laid bare the tangible consequences of climate inaction, spotlighting the growing economic and social costs of extreme weather phenomena. The aftermath of such disasters not only strains local communities but also places additional stress on the insurance sector, magnifying the economic toll of climate change.

In the face of mounting challenges brought on by climate change, it is imperative for policymakers and stakeholders to adopt a proactive stance in safeguarding homes and communities. The evolving financial landscape, highlighted by the CBO’s latest findings, serves as a critical reminder of the interconnected risks that climate change poses to the housing market, insurance industry, and broader economy. As the global community grapples with these unprecedented challenges, the quest for resilience and adaptability continues to gain paramount importance.

Leave a Reply